41 zero coupon bond face value

Zero-Coupon Bond - TheStreet Zero-coupon bonds don't make interest payments. Instead, they are issued at a discount to face value and mature at face value. For example, a bond with a face value of $1000 might be issued at a ... Bootstrapping Zero Curve & Forward Rates ... 22.10.2016 · 10. Let us now move to the next bond, the 0.5 year tenor bond. Its cash flows are as follows: Coupon 25 = 0.97; Coupon 50 + Principal 0.50 = 100.97; 11. The present value of this bond at time zero should equal 100 under our par bond assumption. Hence, according to the price formula we have:

Zero Coupon Bond Calculator - What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world.

Zero coupon bond face value

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money.It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Zero Coupon Bond Calculator - MiniWebtool A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face value. It is also called a discount bond or deep discount bond. Formula Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of moneyTime Value of MoneyThe time value of money is a basic financial concept that holds that money in the present is worth more than the same sum of money to be received in the future.. The time value o...

Zero coupon bond face value. Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero Coupon Bond Value Calculator - buyupside.com Zero Coupon Bond Value Calculator Compute the value (price) of a zero coupon bond. The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2 Related Calculators Bond Convexity Calculator Zero Coupon Bond Questions and Answers - Study.com A zero-coupon bond with a face value of $100 has one year until maturity. There is a 99% chance you will receive the promised payment in 1 year. The only other possible outcome is getting $0 of the... Zero Coupon Bond Definition and Example | Investing Answers Let's say you wanted to purchase a zero-coupon bond that has a $1,000 face value, with a maturity date three years from now. You've determined you want to earn 5% per year on the investment. Using the formula above you might be willing to pay: $1,000 / (1+0.025)^6 = $862.30

Zero Coupon Bond Yield: Formula, Considerations, and ... The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a... Zero Coupon Bond - Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. Zero-Coupon Bond Value | Formula, Example, Analysis ... Zero-Coupon Bond Value Formula Price = \dfrac {M} { (1 + r)^ {n}} Price = (1+r)nM M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity Face Value is equivalent to the bond's future or maturity value. The formula above applies when zero-coupon bonds are compounded annually. 14.3 Accounting for Zero-Coupon Bonds - Financial Accounting This zero-coupon bond was sold for $2,200 below face value to provide interest to the buyer. Payment will be made in two years. The straight-line method simply recognizes interest of $1,100 per year ($2,200/2 years). Figure 14.11 December 31, Years One and Two—Interest on Zero-Coupon Bond at 6 Percent Rate—Straight-Line Method

How to Calculate the Price of a Zero Coupon Bond ... Divide the face value of the bond to calculate the price to pay for the zero-coupon bond to achieve your desired rate of return. Zero-Coupon Bond Price Example For example, say you want to earn a 6 percent rate of return per year on a bond with a face value of $2,000 that will mature in two years. Q Question A year zero coupon bond has a face value of X ... Q Question Consider a coupon bond with a face value of, and maturity of years. It pays coupons annually, and the coupon rate is.You estimate that there is a chance that the firm that issued the bond will go bankrupt before the first coupon is due. If the firm does pay the first coupon, however, there is a chance that it will make all subsequent payments (and a chance that it will not make any ... How Do Zero Coupon Bonds Work? - SmartAsset When the bond matures, the bondholder is repaid an amount equal to the face value or par value of the bond. Bonds are sometimes issued at a discount below its par value. For example, if you buy a bond at a discount for $940, the par value may still be $1,000. What Is a Zero-Coupon Bond? | The Motley Fool 9 hours ago · Price of Zero-Coupon Bond = Face Value / (1+ interest rate/2) ^ time to maturity*2 Price of Zero-Coupon Bond = $10,000 / (1.025) ^ 20 = $6,102.77 With semiannual compounding, we see the bond...

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years.

Suppose you buy a zero coupon bond with face value | Chegg.com Suppose you buy a zero coupon bond with face value $10, and a "bull spread" i.e. the combination of a long call with strike X=50 and a short call with strike X=60. All have the same maturity. Which strategy gives you an equivalent payoff? A.Protective put. B.Covered call.

compute the price of a 90-day zero coupon bond with a face ... compute the price of a 90-day zero coupon bond with a face value of $100 if the market yield is 6 percent. Unless indicated otherwise, assume that 1 year = 365 days, and that interest is compounded annually. and the textbook answer is = 100/(1+0.06*90/365) I thought it should be 100/(1+0.06/365)^90.

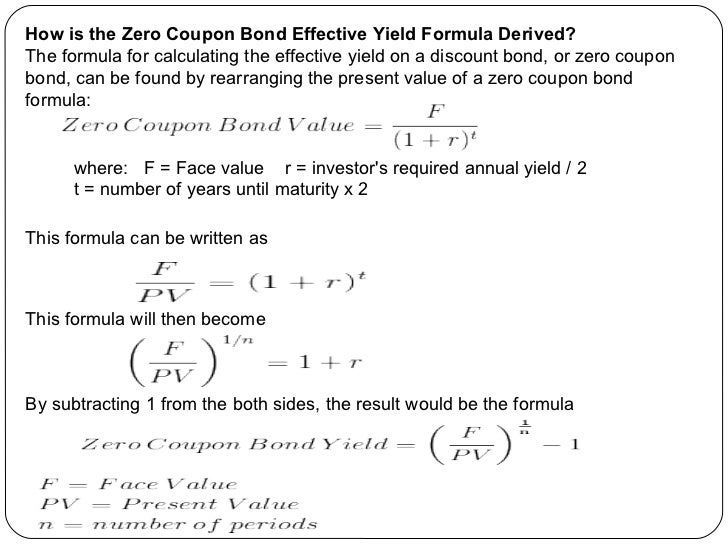

Zero Coupon Bond Yield - Formula (with Calculator) The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at ...

What Is a Zero-Coupon Bond? Definition, Advantages, Risks For example, a zero-coupon bond with a face value of $20,000 that matures in 20 years with an interest rate of 5.5% might sell for around $7,000. At maturity, two decades later, the investor will ...

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. It plays a crucial role in generating higher rewards from an investment. read more that will be earned …

A zero coupon bond with a face value of $11,000.00 | Chegg.com A zero coupon bond with a face value of $11,000.00 matures in 18 years. What should the bond be sold for now if its rate of return is to be 5.857% compounded annually? Current selling price: [Note: Your answer is a dollar amount and should have a dollar sign and exactly two decimal places.] a a

/five_thousand_dollar_series_i_savings_bond-56a091263df78cafdaa2cb4c.gif)

Post a Comment for "41 zero coupon bond face value"