39 what is meant by coupon rate

Coupon Types - Financial Edge Coupon Types - Example. An investor purchased an FRN issued by a bank with a US$100 million face value (FV). The coupon formula is 3-Month Libor + 1.2% (i.e. 2.68% + 1.2% = 3.88%). The coupon rate (3.88%) is given by the coupon formula - with quarterly interest payments. Assume that LIBOR has been fixed at 2.68%. Coupon-rate Definitions | What does coupon-rate mean? | Best 1 ... Define coupon-rate. Coupon-rate as a means The coupon rate is the rate of interest that is payable on a bond yearly. This rate is determined at the time the bond i....

› createJoin LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

What is meant by coupon rate

› newyorkCBS New York - Breaking News, Sports, Weather, Traffic and ... School district: 13-year-old boy dies in Coram hit-and-run Police said the boy suffered critical injuries, but his sister is expected to be OK. Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower. › de › jobsFind Jobs in Germany: Job Search - Expat Guide to Germany ... Browse our listings to find jobs in Germany for expats, including jobs for English speakers or those in your native language.

What is meant by coupon rate. Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total ... Coupon rate financial definition of Coupon rate - TheFreeDictionary.com Coupon rate. The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons. What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same.

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities. Difference Between Coupon Rate and Interest Rate The coupon rate is also known as the nominal rate. It is defined by the fixed interest secrets of the bondholder. The final amount will be received by the holder at the end of the maturity period. Additionally, the coupon rate will be stable till the bondholder receives his money. Readers who read this also read: Difference Between Coupon Rate and Interest Rate Interest rate is the rate charged for a borrowing. • Coupon Rate is calculated considering the face value of the investment. Interest rate is calculated considering the riskiness of the lending. • Coupon rate is decided by the issuer of the securities. Interest rate is decided by the lender. Coupon rate Definition & Meaning | Dictionary.com coupon rate noun the interest rate fixed on a coupon bond or other debt instrument. SHALL WE PLAY A "SHALL" VS. "SHOULD" CHALLENGE? Words nearby coupon rate coupon, coupon bond, coupon clipper, couponer, couponing, coupon rate, coup stick, courage, courage of one's convictions, have the, courageous, courant

Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms... Coupon rate - definition and meaning - Market Business News Coupon rate - definition and meaning. The coupon rate is the interest rate that the issuer of a bond pays, which normally happens twice a year. The bondholder receives the interest payments during the lifetime of the bond. ... Coupon rate - example. Assume that a bond has a par value of $5,000 and a coupon rate of 5%. This would make total ... Coupon Bond - Guide, Examples, How Coupon Bonds Work What is a Coupon Bond? A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.Bonds that have higher coupon rates offer investors higher yields on their investment. Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA Coupon Rates are much more flexible. Interest Rates remains more or less static during the tenure of the loan. The coupon Rate is not generally linked to any other debt instrument. Interest Rate is generally linked to a benchmark lending rate. Coupon Rates are high in percentage in comparison to interest rate.

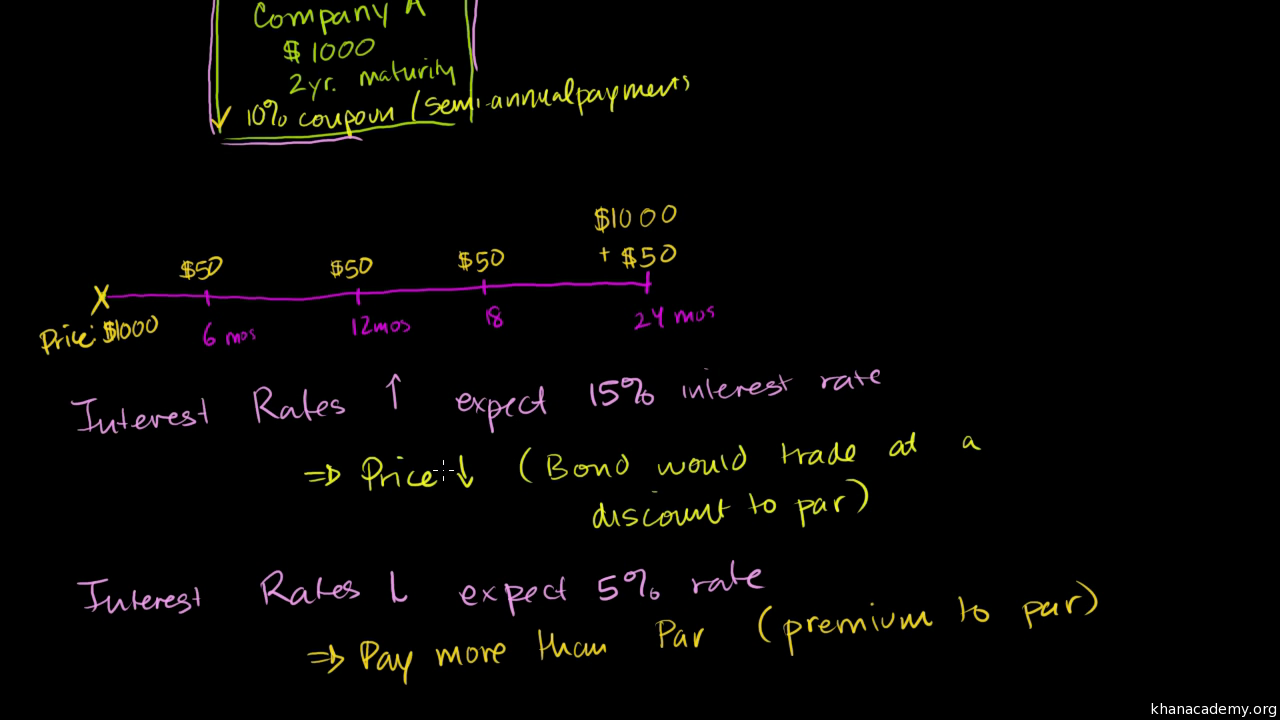

What Is Coupon Rate and How Do You Calculate It? - SmartAsset Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered ...

Coupon Rate - Meaning, Calculation and Importance - Scripbox The bond's coupon rate refers to the amount of annual interest the bondholder receives from the bond's issuer. Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. Moreover, the coupon payments are fixed for a bond throughout its tenure.

Coupon Rate: Formula and Calculation - Wall Street Prep Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% = $6,000. Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k ...

Coupon Rate vs Interest Rate | Top 8 Best Differences ... - WallStreetMojo a coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and …

Coupon Rate | Definition | Finance Strategists A coupon rate is the interest attached to a fixed income investment, such as a bond. When bonds are bought by investors, bond issuers are contractually obligated to make periodic interest payments to their bondholders. Interest payments represent the profit made by a bondholder for loaning money to the bond issuer.

home.treasury.gov › policy-issues › financialSanctions Programs and Country Information | U.S. Department ... Oct 06, 2022 · OFAC administers a number of different sanctions programs. The sanctions can be either comprehensive or selective, using the blocking of assets and trade restrictions to accomplish foreign policy and national security goals. Where is OFAC's country list? Active Sanctions Programs: Program Last Updated: Afghanistan-Related Sanctions 02/25/2022 Balkans-Related Sanctions 10/03/2022 Belarus ...

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail.

What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued. What Does Coupon Rate Mean?

› entertainment-artsEntertainment & Arts - Los Angeles Times The late actress’ oldest son, 20-year-old Homer Laffoon, will retain control over his mother’s estate while a legal battle with her ex-boyfriend James Tupper continues.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision The coupon rate is an interest rate that the issuer agrees to pay every year on fixed income security. It is also known as the nominal rate, and it is paid every year till maturity. The method to calculate coupons is fairly straightforward.

What is coupon rate | Definition and Meaning | Capital.com A coupon rate for a fixed-income security represents an annual coupon payment that the issuer pays according to the bond's par or face value. The coupon payment on a bond is the interest payment received by the holder of the bond until the bond matures. Coupon rate formula The coupon rate calculations formula is simple.

› account › subscribeSubscribe to Find-A-Code The one-stop-shop for CPT, HCPCS, ICD-10-CM, ICD-10-PCS, medical billing codes, provider documentation, Medicare coding information and more.

mediagazer.comMediagazer Oct 10, 2022 · Mediagazer presents the day's must-read media news on a single page. The media business is in tumult: from the production side to the distribution side, new technologies are upending the industry.

Coupon Rate Formula | Step by Step Calculation (with Examples) In other words, it is the stated rate of interest paid on fixed-income securities, primarily applicable to bonds. The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%

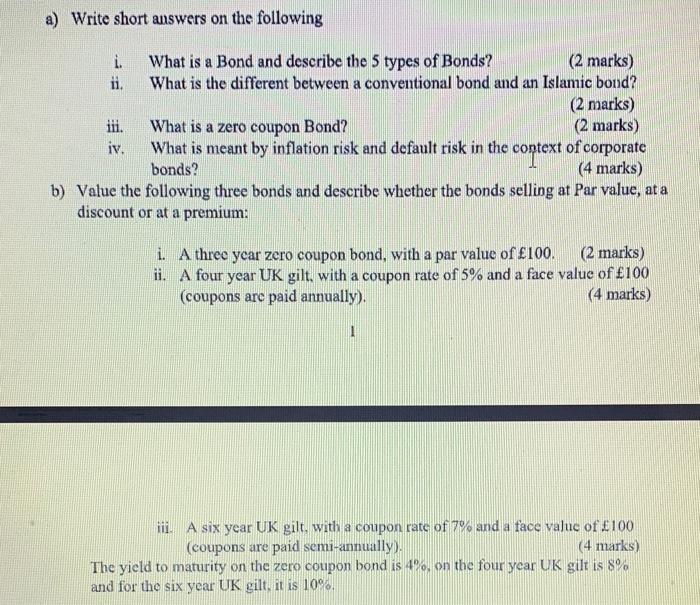

What is a Coupon Rate? (with picture) - Smart Capital Mind The coupon rate, also called the coupon, is the yearly interest rate payout on a bond that is communicated as a percentage of the value of the bond. Some bonds, called zero coupon bonds, are issued for less than face value and assigned no coupon rate.

Difference Between Coupon Rate and Required Return Coupon Rate is the periodical price that the buyer receives until the bond matures. Required Return is the amount paid for the investor to own the risks. The coupon rate is calculated using the formula Coupon rate = ( Total annual payment/par value of bond) * 100. Required Return is calculated by using the beta value.

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

› de › jobsFind Jobs in Germany: Job Search - Expat Guide to Germany ... Browse our listings to find jobs in Germany for expats, including jobs for English speakers or those in your native language.

Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower.

› newyorkCBS New York - Breaking News, Sports, Weather, Traffic and ... School district: 13-year-old boy dies in Coram hit-and-run Police said the boy suffered critical injuries, but his sister is expected to be OK.

/GettyImages-140671550-56a636e83df78cf7728bdbc1.jpg)

:max_bytes(150000):strip_icc()/-1000-denomination-us-savings-bonds-172745598-5c729ac546e0fb0001718a0c.jpg)

:max_bytes(150000):strip_icc()/manlookingatcomputer-2368f094bfc7428b8e7b86e34186139d.jpeg)

Post a Comment for "39 what is meant by coupon rate"