41 how to determine coupon rate

How To Find Coupon Rate Of A Bond On Financial Calculator Once you have this information, you can follow these steps to calculate the coupon rate: 1) Enter the face value of the bond into the calculator. 2) Enter the coupon rate into the calculator. 3) Enter the number of years until the bond matures into the calculator. 4) Enter the market interest rate into the calculator. home.treasury.gov › news › press-releasesPress Releases | U.S. Department of the Treasury Exchange Rate Analysis. U.S.-China Comprehensive Strategic Economic Dialogue (CED) ... Treasury Coupon Issues. Corporate Bond Yield Curve. Receipts & Outlays.

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Online coupon rate calculation. Use this simple finance coupon rate calculator to calculate coupon rate.

How to determine coupon rate

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%. Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = Reference Rate + Quoted Margin The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be - Coupon Rate = 5-Year Treasury Yield + .05% Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo As per the given question, Par value of bond = $1,000. Annual interest payment = 4 * Quarterly interest payment. = 4 * $15. = $60. Therefore, the coupon rate of the bond can be calculated using the above formula as, Since the coupon (6%) is lower than the market interest (7%), the bond will be traded at a discount.

How to determine coupon rate. What Is Coupon Rate and How Do You Calculate It? A bond's coupon price could be calculated by dividing the sum of the safety's annual coupon payments and dividing them by the bond's par worth. For instance, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with larger coupon rates are extra desirable for ... › databases › questiaQuestia - Gale Individual subscriptions and access to Questia are no longer available. We apologize for any inconvenience and are here to help you find similar resources. › en-us › moneyMSN MSN How to Measure the ROI of Discount Coupons? - Voucherify With Voucherify, you can build the following coupon types: Amount (e.g. $10 off) Percentage (e.g. 20% off) Unit (e.g. 2 free piano classes) Free shipping Fixed amount Dynamic discounts Once the digital coupon code is created, the tracking is super simple. In this case, you just monitor the number of redemptions.

› lifestyleLifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of... Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link How to calculate Discount Rate with Examples - EDUCBA Calculate the discount rate if the compounding is to be done half-yearly. Discount Rate is calculated using the formula given below. Discount Rate = T * [ (Future Cash Flow / Present Value) 1/t*n - 1] Discount Rate = 2 * [ ($10,000 / $7,600) 1/2*4 - 1] Discount Rate = 6.98%. Therefore, the effective discount rate for David in this case is 6 ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Enter your name and email in the form below and download the free template now! How the Coupon Rate Affects the Price of a Bond All types of bonds pay interest to the bondholder. 4 Steps to Evaluate Coupon Advertising - indoormedia.com To measure the success of your ad campaign, a simple formula to follow is: Average Overbuy X Total Coupons Redeemed = Sales Revenue generated from promotions. - Cost of Goods Sold (This is the wholesale cost of goods.) - Cost of Giveaway (This is the wholesale cost of the discount.) - Cost of the Ad (Amount paid to RTUI for coupon ...

Interest Rate Sensitivity - Overview, How To Measure, Example For the discount rate r, we are using the coupon rate of the bond. With the numerator and denominator solved, we put those together to get a Macaulay duration of 3.856. It means that it will take approximately 3.856 years of holding the bond for its cash flows to cover its price.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset The coupon rate is calculated by adding up the total amount of annual payments made by a bond, then dividing that by the face value (or "par value") of the bond. For example: ABC Corp. releases a bond worth $1,000 at issue. Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value:

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate...

Coupon Payment Calculator You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50

How To Determine A Discount Rate Coupon, Coupon or Promo Codes Big coupon code, coupon code, promotion code, discount code. 159.223.93.251 . Coupons Codes; Promo Codes; Top Deals; Top Searched; Top Stores; Coupons Codes; ... How To Determine A Discount Rate. 6.98%. OFF. How to calculate Discount Rate with Examples - EDUCBA

What Is a Coupon Rate? - Investment Firms How Do You Calculate the Coupon Rate? Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder.

How to determine a new bond's appropriate coupon rate I start with a bond issue's par value, YTM, and desired price. I then determine the appropriate coupon rate.==I'm a Finance Professor at the University of Te...

How to Calculate a Coupon Payment | Sapling Twice-yearly equal coupon payments. If your security's par value is $1,000, and you receive two coupon payments of $25 each, your annual payment is $50 ($25 x 2 payments each year). Your coupon rate is 5 percent: $50 (total annual coupon payment) divided by $1,000 (par value) x 100 percent. Unequal periodic payments.

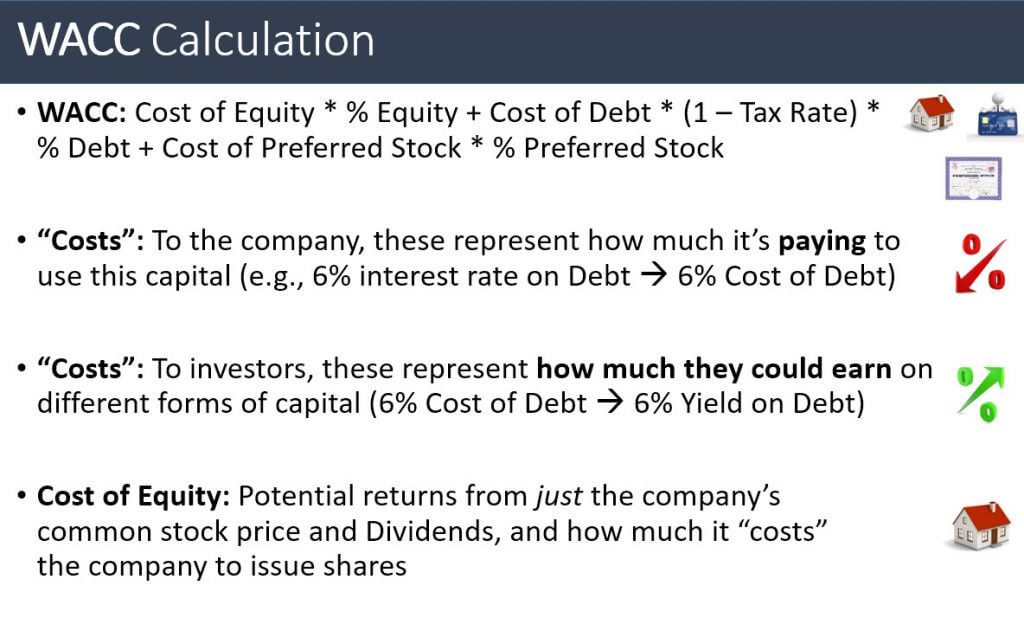

How To Determine Discount Rate - couponuu.com How to Calculate Discount Rate in a DCF Analysis. CODES (6 days ago) How to Calculate Discount Rate: WACC Formula. The formula for WACC looks like this: WACC = Cost of Equity * % Equity + Cost of Debt * (1 - Tax Rate) * % Debt + Cost of Preferred Stock … Visit URL. Category: coupon codes Show All Coupons

› finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

What is Coupon Rate? (Formula + Calculator) - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon ÷ Par Value of Bond For example, if the interest rate pricing on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6%

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon Rate = (20 / 100) * 100. Coupon Rate = 20%. Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities.

What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 per cent, you will get Rs 200 every year for 10 years, no matter what happens to the bond price in the market.

Genetic Testing For Health, Ancestry And More - 23andMe Limit 3 kits. Savings based on regular price $199 / per kit. Entry of your email address is not necessary to redeem the offer. I consent to the transfer and validation of my email address in conjunction with this email service.

Coupon Rate: Definition, Formula & Calculation - Study.com The coupon rate is the annualized interest also referred to as the coupon, divided by the initial loan amount. The initial loan amount is the par value. In the example given, the coupon rate is ...

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow Step 1, Get the bond's face value. The first piece of information is the actual face value of the bond, sometimes called its par value.[2] X Research source Note that this value might be (and probably is) different from what you paid for the bond. It's given to you by your broker.Step 2, Locate the bond expiration. You'll also need to locate the bond expiration or maturity date.[3] X Research source That way, you can get a sense of how long you'll be receiving coupons and when you can expect ...

How To Determine The Discount Rate Coupon, Coupon or Promo Codes For instance, let us assume ABC Inc. is planning to raise funds through the issue of a 5-year bond, having a par value of US $ 1000 at a coupon rate of 5%p.a. However, the prevailing market interest rate was 6% at the time of the issue. Now, the company has to issue its bond at a discount to compensate for the return on investment of the ...

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo As per the given question, Par value of bond = $1,000. Annual interest payment = 4 * Quarterly interest payment. = 4 * $15. = $60. Therefore, the coupon rate of the bond can be calculated using the above formula as, Since the coupon (6%) is lower than the market interest (7%), the bond will be traded at a discount.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = Reference Rate + Quoted Margin The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be - Coupon Rate = 5-Year Treasury Yield + .05%

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%.

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "41 how to determine coupon rate"