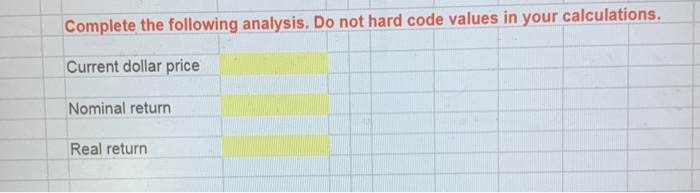

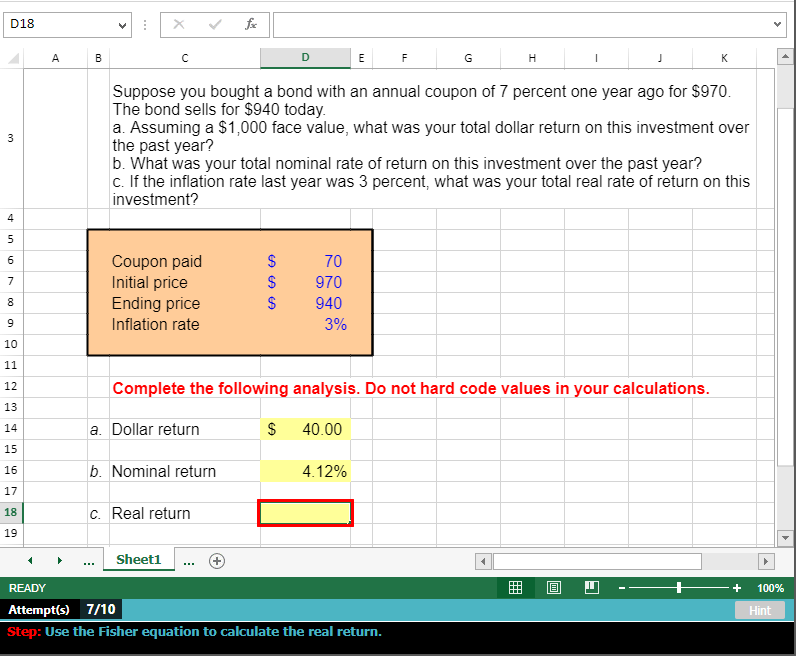

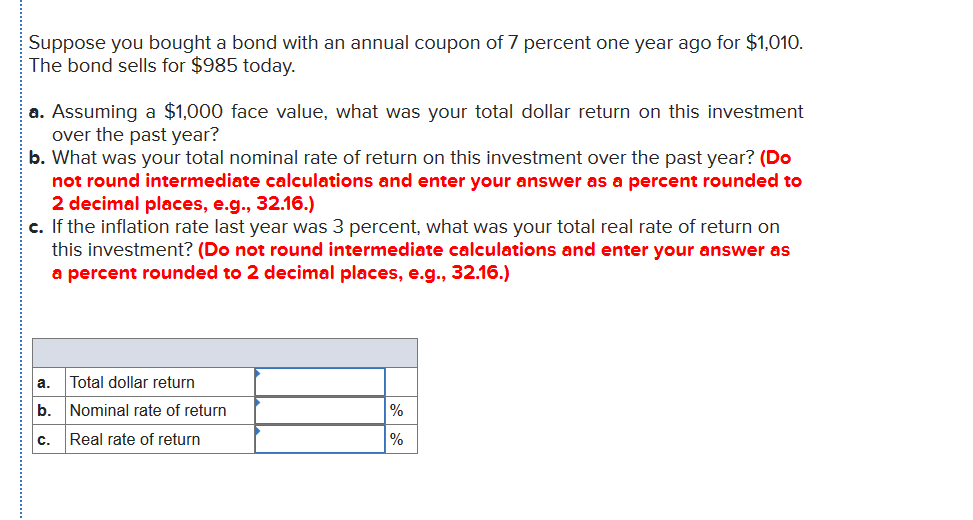

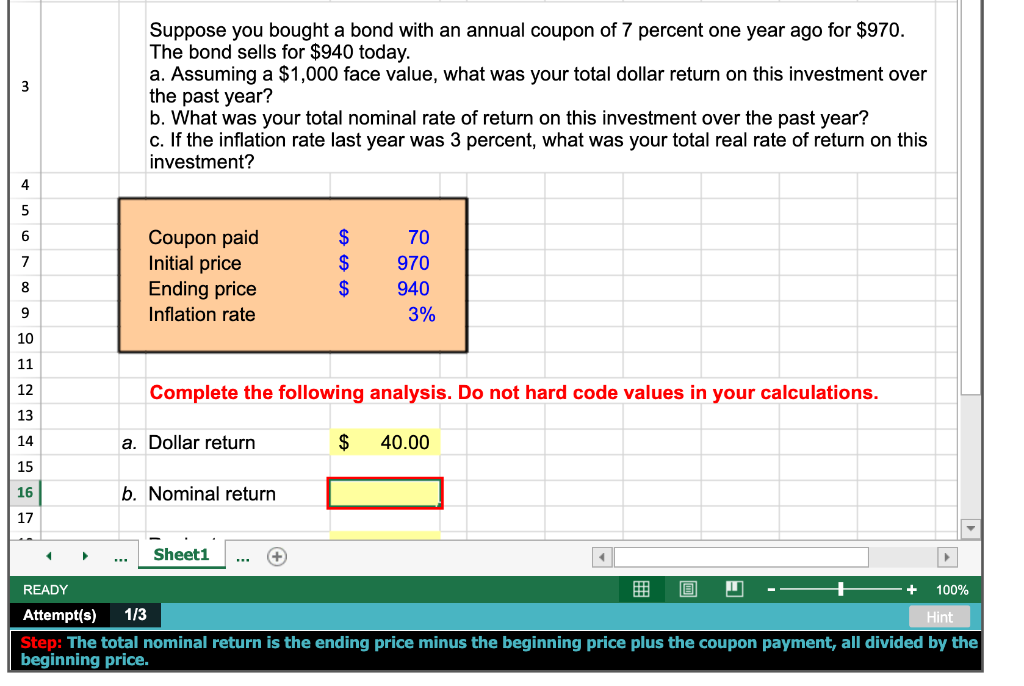

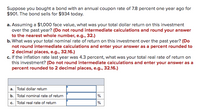

44 suppose you bought a bond with an annual coupon of 7 percent

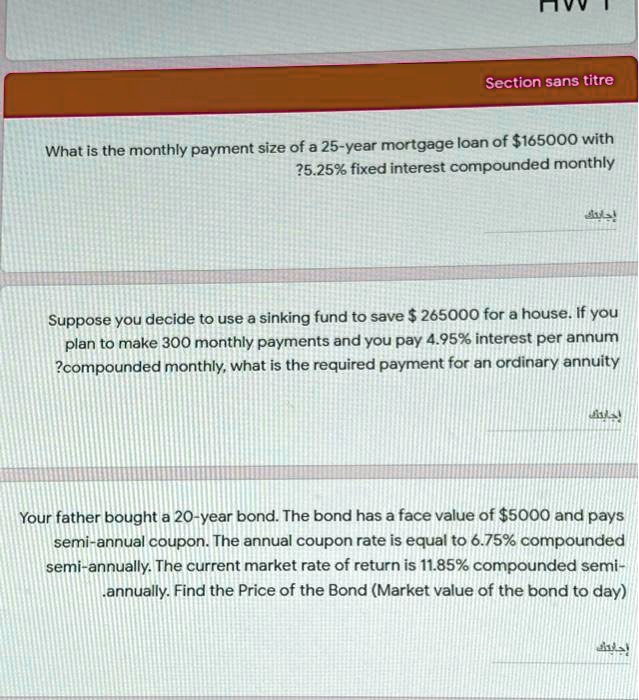

Assignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. Chapter 7 - Business Marketing Flashcards | Quizlet You want to buy a house within 3 years, and you are currently saving for the down payment. You plan to save $9,000 at the end of the first year, and you anticipate that your annual savings will increase by 5% annually thereafter. Your expected annual return is 8%. How much will you have for a down payment at the end of Year 3?

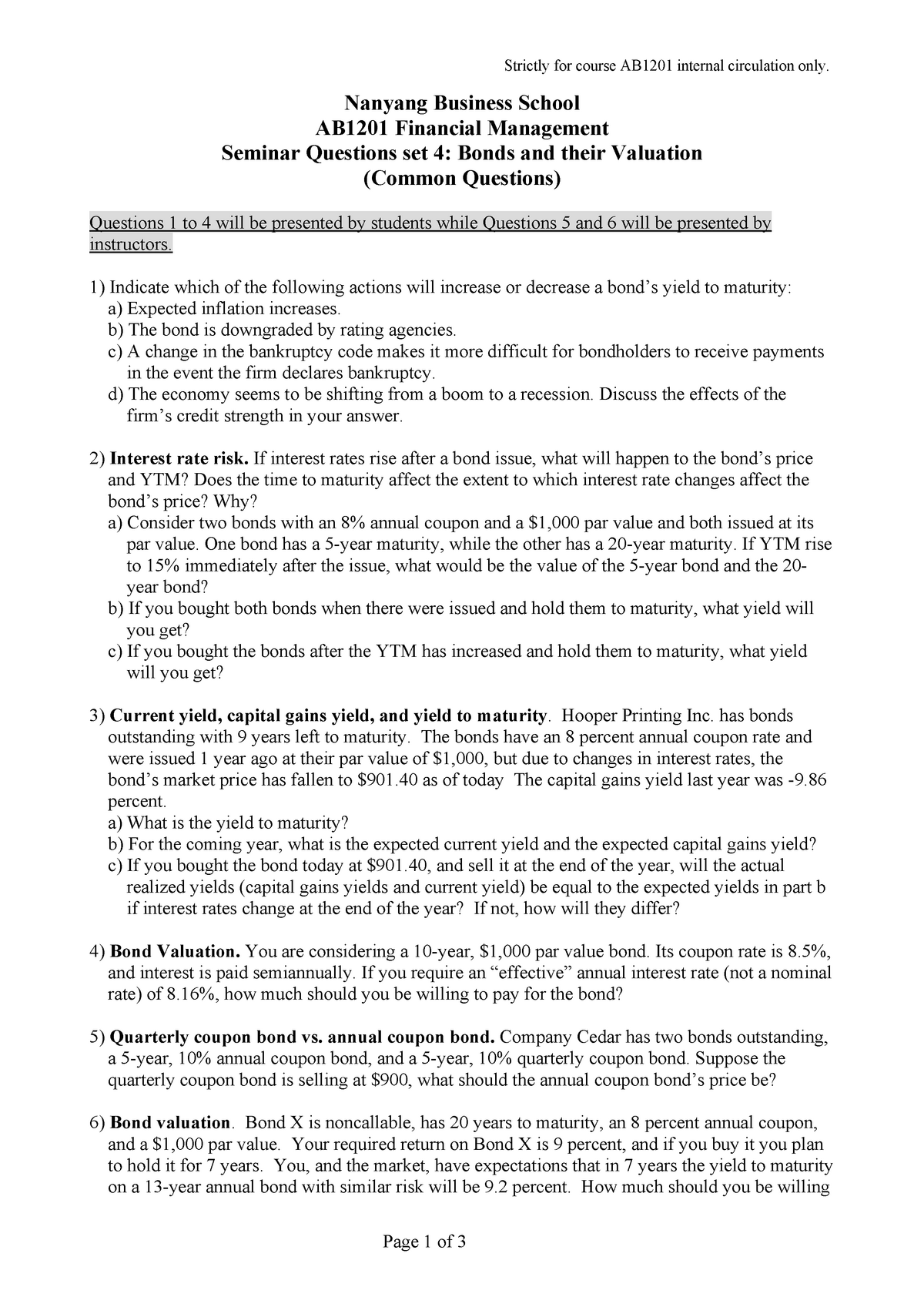

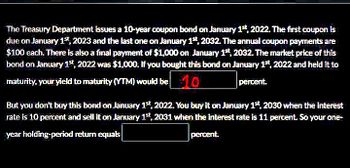

Chapter 5 Flashcards | Quizlet The real risk-free rate is 2.05%. Inflation is expected to be 3.05% this year, 4.75% next year, and 2.3% thereafter. The maturity risk premium is estimated to be $0.05 \times(t-1) \%$, where t=number of years to maturity. What is the yield on a 7-year Treasury note?

Suppose you bought a bond with an annual coupon of 7 percent

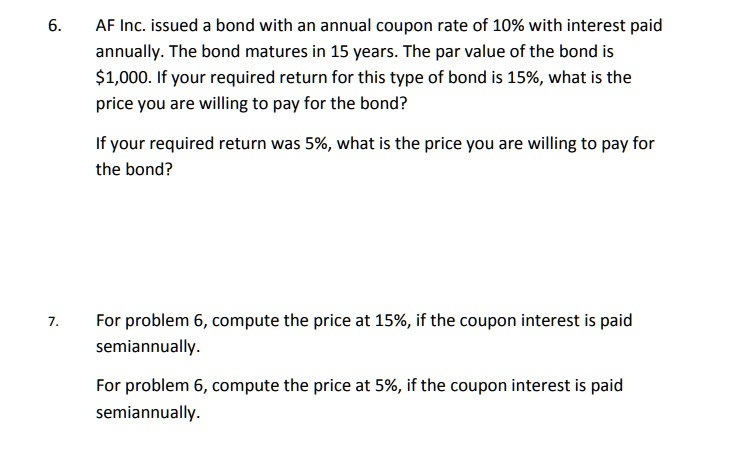

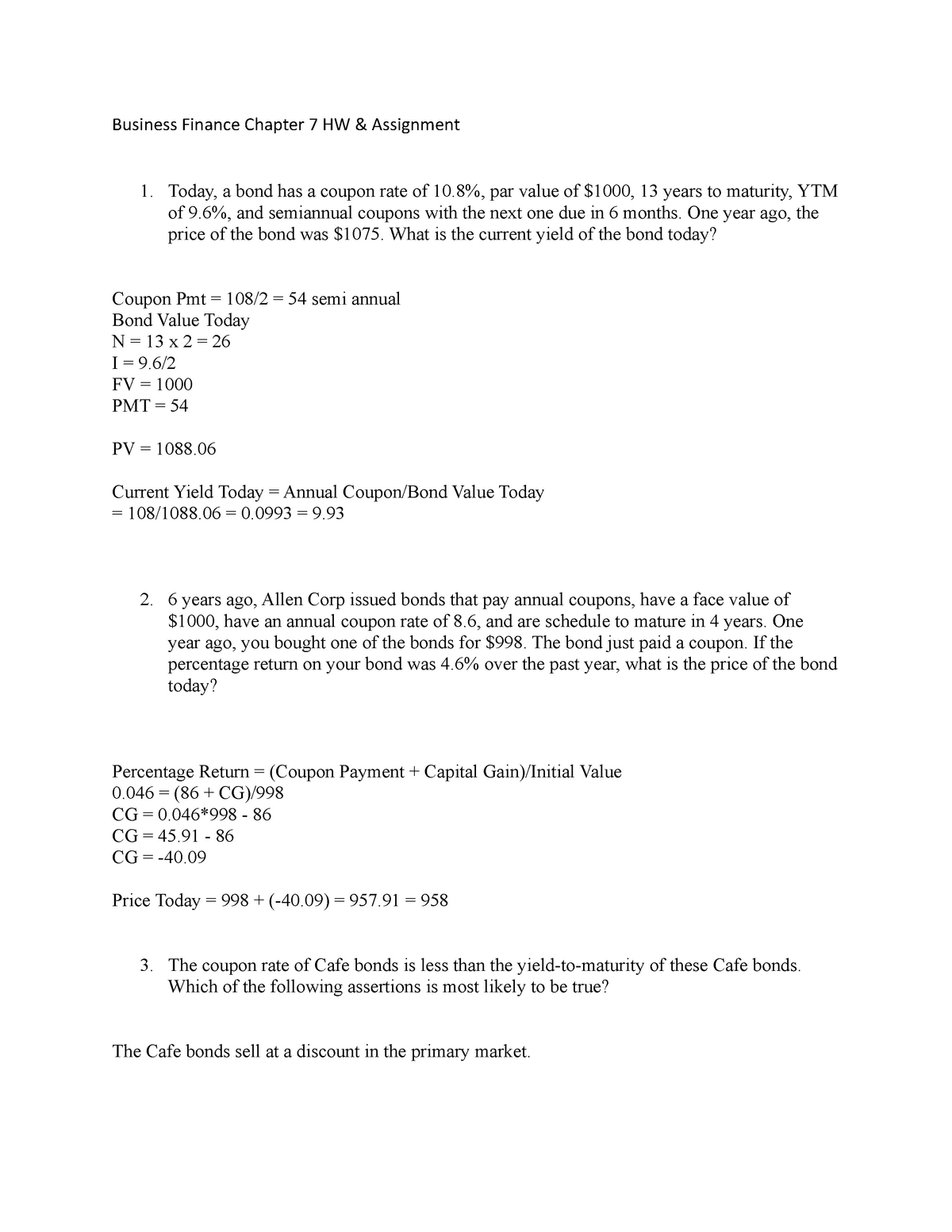

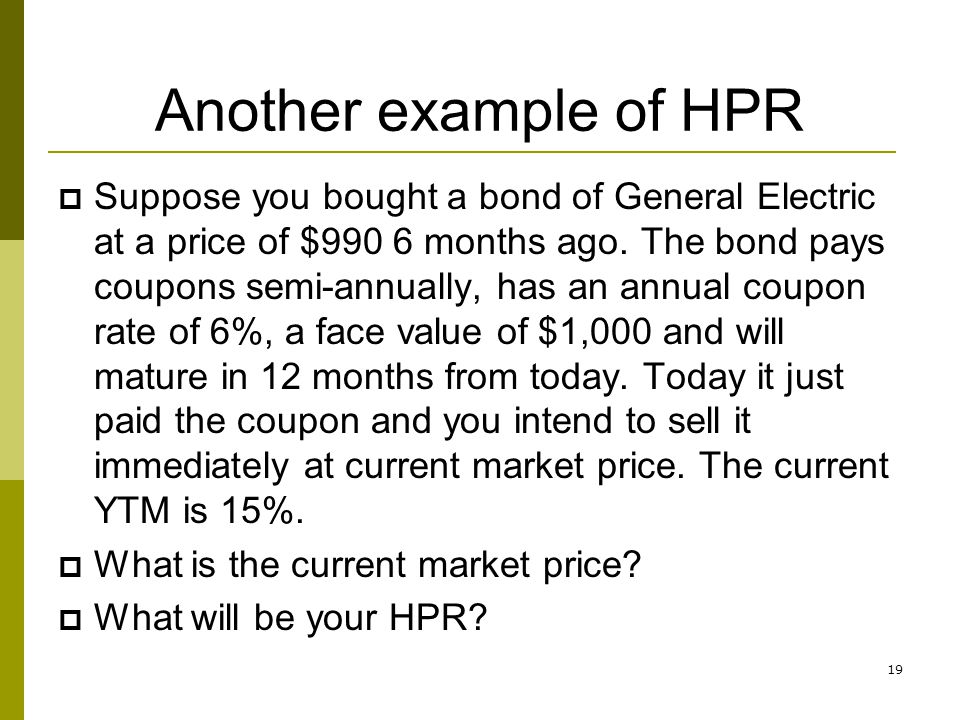

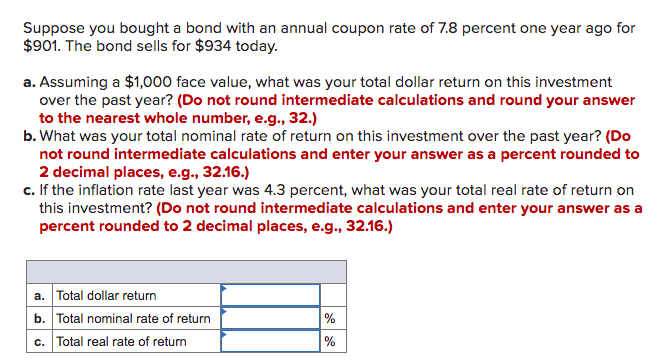

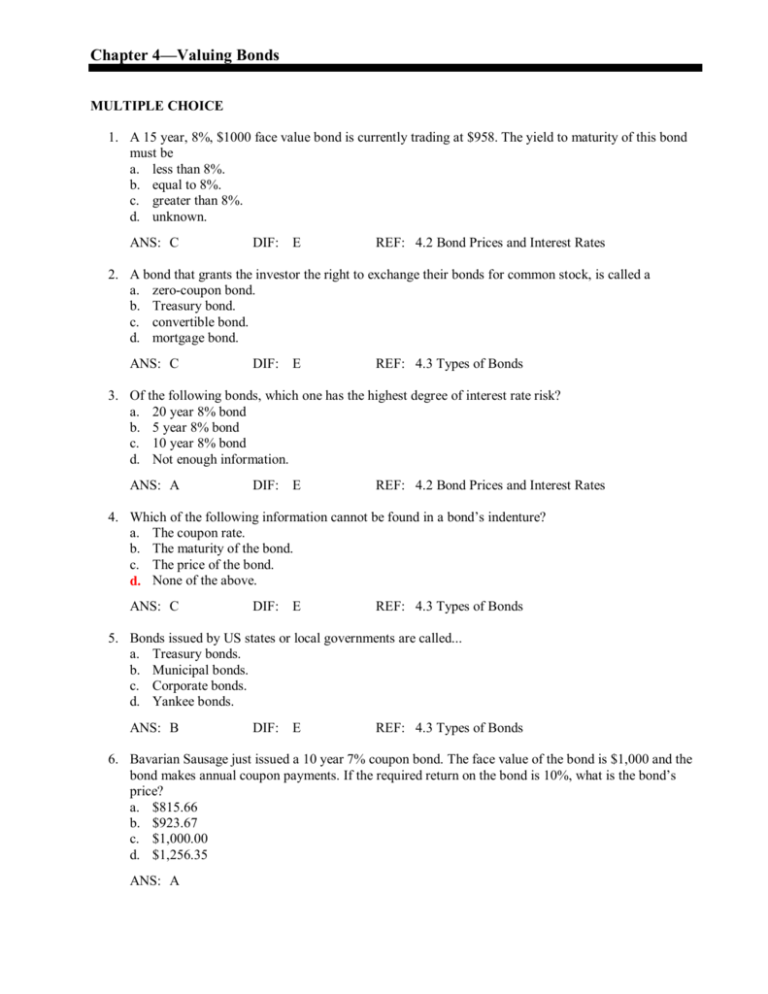

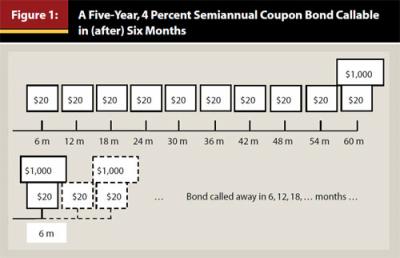

Answered: How is the value of a bond determined?… | bartleby f. How does the calculation for valuing a bond change if semiannual payments are made? Find the value of a 10-year, semiannual payment, a 10 percent coupon bond if investor’s required rate of return is 13%. 1. What is the bond's yield to call (YTC)? 2. If you bought this bond, do you think you would be more likely to earn the YTM or the YTC? Why? Fortune - Fortune 500 Daily & Breaking Business News | Fortune The Best MBA Programs in 2022 Fortune Education wants to help you decipher the best of what the business school landscape has to offer. Discover which 76 schools made our second annual ranking of ... How to Calculate Bond Total Return: 3 Ways to Assess the ... - wikiHow Nov 05, 2020 · In either case, you still receive interest payments based on the face value and coupon rate of the bond. The annual interest payments on the bond are $50,000 ($500,000 * .10 = $50,000). When a bond matures, you get the face value of the bond. Whether you bought the bond at a discount or a premium, upon maturity you receive the face value.

Suppose you bought a bond with an annual coupon of 7 percent. (PDF) Engineering-Economics.pdf | Lukman Hakim - Academia.edu Enter the email address you signed up with and we'll email you a reset link. Fantasy News, Player Stats, Rumors and Rankings - CBSSports.com Stay at the top of your fantasy leagues with CBS Sports. Your source for in-depth fantasy sports news, stats, scores, rumors, and strategy. NMIMS Customized Assignments. NMIMS Solved Assignments … You have great chances to get the essays for free. Direct Communication and Support. You can easily control the writing process based on your needs; we help you a lot. You can approach our writers directly and requesting drafts. Our dedicated team of experts is available to offer responsive support for 24/7. So just contact us, we ready to help ... Success Essays - Assisting students with assignments online Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

How to Calculate Bond Total Return: 3 Ways to Assess the ... - wikiHow Nov 05, 2020 · In either case, you still receive interest payments based on the face value and coupon rate of the bond. The annual interest payments on the bond are $50,000 ($500,000 * .10 = $50,000). When a bond matures, you get the face value of the bond. Whether you bought the bond at a discount or a premium, upon maturity you receive the face value. Fortune - Fortune 500 Daily & Breaking Business News | Fortune The Best MBA Programs in 2022 Fortune Education wants to help you decipher the best of what the business school landscape has to offer. Discover which 76 schools made our second annual ranking of ... Answered: How is the value of a bond determined?… | bartleby f. How does the calculation for valuing a bond change if semiannual payments are made? Find the value of a 10-year, semiannual payment, a 10 percent coupon bond if investor’s required rate of return is 13%. 1. What is the bond's yield to call (YTC)? 2. If you bought this bond, do you think you would be more likely to earn the YTM or the YTC? Why?

Post a Comment for "44 suppose you bought a bond with an annual coupon of 7 percent"